What just went down in the world’s largest tax auction? This year was the same as years’ past, except this year it has extra zeros on the end – for the first time, burned out structures fetched full prices in the first round.

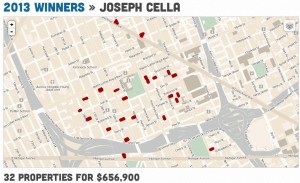

A map of the properties Joseph Cella purchased last Monday (whydontweownthis.com)

Joseph Cella and his family (linkedin.com)

A home typical of Cella’s recent purchases (nextcity.com)

Here’s a case study – Joseph Cella, the founder and principal of “The Pontifex Group”, recently purchased 32 properties, totaling over $650,000 last Monday. His firm is a “boutique consulting firm that provides strategic and tactical consulting to corporations, high net-worth individuals, associations, non-profits, elected officials and candidates.” While a few of these properties were vacant land or “salvageable” houses, many were burnt out shells or completely scrapped and void of metal objects. His bidding pattern looks very algorithmic, almost as if he drew a circle around downtown and haphazardly bid on anything and everything within it. He chose not to wait until the second round, one month later, in which minimum bids are dropped to a paltry $500.

Was he bidding on behalf of a “client”? Is he flush with cash and taking a gamble? Does he know something that others don’t?

Luckily Wayne County has changed rules and now has a reversion clause in the quit claim deed he’ll receive. The winning bidder now has obligations they must adhere to, else the property revert back to the county:

- The winner must pay 2013, 2014, and 2015 taxes.

- The winner must, within six months, demolish the structure or secure it and maintain it to local health standards and building codes.

Failure to comply with these rules, following a 30-day notice from the Treasurer, will cause the title to revert back to the City, County, or State at the Treasurer’s discretion.

Will this recent “shopping spree” simply be a delay in the inevitable? Has the Treasurer pocketed more cash, simply to have the option to sell it again in a mere 6 months?

Let’s keep an eye on this guy, attempt to reach out and determine what his plans are. There’s a chance he’s buying these to demolish and/or develop, or is aware of a larger development plan in which he can initiate or delay.

This blog post was contributed by: Darin McLeskey (@darinmcleskey).